The 10-Minute Rule for Hsmb Advisory Llc

The 10-Minute Rule for Hsmb Advisory Llc

Blog Article

Top Guidelines Of Hsmb Advisory Llc

Table of ContentsHsmb Advisory Llc for DummiesThings about Hsmb Advisory LlcOur Hsmb Advisory Llc PDFsHsmb Advisory Llc Fundamentals ExplainedThe Hsmb Advisory Llc IdeasHsmb Advisory Llc Things To Know Before You Get This

Ford says to guide clear of "cash money value or long-term" life insurance policy, which is even more of a financial investment than an insurance. "Those are very complicated, featured high commissions, and 9 out of 10 people don't require them. They're oversold since insurance representatives make the largest payments on these," he says.

Handicap insurance can be pricey. And for those who choose for long-term care insurance policy, this plan may make special needs insurance coverage unneeded.

What Does Hsmb Advisory Llc Mean?

If you have a chronic health worry, this kind of insurance policy can wind up being critical (St Petersburg, FL Life Insurance). However, don't let it stress you or your bank account early in lifeit's typically best to get a policy in your 50s or 60s with the expectancy that you will not be using it until your 70s or later.

If you're a small-business owner, consider safeguarding your livelihood by purchasing business insurance. In case of a disaster-related closure or duration of restoring, company insurance can cover your income loss. Consider if a substantial climate event influenced your store or production facilityhow would certainly that influence your revenue? And for how much time? According to a report by FEMA, between 4060% of small companies never reopen their doors following a calamity.

Plus, utilizing insurance coverage might often cost more than it saves in the long run. If you obtain a chip in your windscreen, you might think about covering the repair work expense with your emergency situation cost savings instead of your auto insurance. Why? Because utilizing your car insurance coverage can cause your month-to-month premium to go up.

The Best Guide To Hsmb Advisory Llc

Share these tips to secure enjoyed ones from being both underinsured and overinsuredand seek advice from with a relied on professional when needed. (https://www.gaiaonline.com/profiles/hsmbadvisory/46584207/)

Insurance policy that is bought by a private for single-person coverage or protection of a family. The specific pays the premium, in contrast to employer-based medical insurance where the company typically pays a share of the premium. People may buy and acquisition insurance from any type of plans offered in the person's geographic area.

Individuals and families may certify for monetary assistance to reduce the cost of insurance costs and out-of-pocket costs, but just when registering through Attach for Wellness Colorado. If you experience certain modifications in your life,, you are qualified for a 60-day period of time where you can sign up in a specific plan, even if it is outside of the yearly open registration period of Nov.

15.

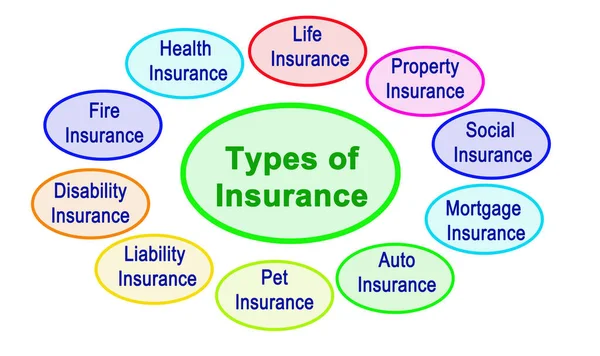

It might appear basic yet recognizing insurance coverage types can likewise be confusing. Much of this complication comes from the insurance sector's recurring objective to develop customized coverage for policyholders. In designing adaptable policies, there are a selection to select fromand all of those insurance kinds can make it difficult to recognize what a certain plan is and does.

The Hsmb Advisory Llc Diaries

The most her latest blog effective location to start is to talk concerning the distinction in between the two sorts of basic life insurance policy: term life insurance policy and permanent life insurance. Term life insurance coverage is life insurance policy that is only energetic temporarily period. If you die throughout this duration, the individual or individuals you've called as recipients may get the cash payout of the policy.

Several term life insurance policy policies allow you convert them to a whole life insurance policy, so you do not lose coverage. Usually, term life insurance policy premium payments (what you pay each month or year right into your plan) are not secured at the time of purchase, so every 5 or 10 years you possess the plan, your costs might climb.

They also tend to be cheaper overall than entire life, unless you get an entire life insurance coverage policy when you're young. There are likewise a couple of variations on term life insurance policy. One, called team term life insurance policy, is typical amongst insurance policy alternatives you might have accessibility to with your employer.

Not known Details About Hsmb Advisory Llc

This is normally done at no expense to the worker, with the ability to acquire additional protection that's taken out of the worker's paycheck. Another variant that you might have accessibility to via your employer is supplemental life insurance coverage (Insurance Advisors). Supplemental life insurance policy might consist of unintentional fatality and dismemberment (AD&D) insurance, or interment insuranceadditional protection that can help your family in instance something unanticipated happens to you.

Irreversible life insurance policy just refers to any kind of life insurance plan that does not run out.

Report this page